The First Timers Checklist For Home Real Estate Investing

Domestic property is something that's exactly very classy and complex concurrently. Within the conceptual levels, many of us view the purpose of shopping for home, and will love after some time, and cashing out at some future date.

System - what is perfect for you? Swift check-list The usual understanding to ignore...or at a minimum think twice about

Finding the approach made just for you

There are numerous non commercial property tactics, all diverse in difficulty. For the health of this information, let us consentrate on high-amount strategies to enable get the added wheels transforming about what type generally is a fantastic match for you personally.

Repair and Make use of

The mend and turn structure is just operate sounds. That's where you locate a property or home you believe you may renovate and market to get a earnings. This may be a short-expression financial commitment technique utilized by expert investors who will position much. Moreover, expert traders most often have contacts and interactions with contractors they will ask without delay for getting building work completed within just spending budget.

This is important to note that small-expression property trades are taxed differently than long-term ventures (more than per year). Our family has produced a directory of clear to see taxation techniques for property investors we recommend looking at.

Self-was able

The personal-managed strategy is 1 the spot where you since the house owner will also accept the control obligations. This method is frequently regarded by real estate investors who are living all-around their attributes and have the data transfer useageAndmoxie to handle stuff like repair, property owners screenings, records and promotion the home and property, let alone staying up-to-date with present property-tenant regulations. This plan reduces your buying size considering the fact that you will certainly plan to be within just affordable driving a car distance regarding crisis situations or fix-it concerns. On the other side, you are going to acquire 100Per cent of the hire whilst taking up the complete proprietor part.

Outsourcing

You will discover range benefits of going with a qualified property manager. They help you save time, pressure, and in some cases cash by steering clear of points that can result in attorney's fees, vacancies, and damage relevant to mishandled problems. Using the services of a seasoned property owner you never know the neighborhood market and hire characteristics also let go you about spend without geographical hindrances, and individual cash flow properties in trading markets that satisfy your allowance and shelling out targets. (Purchasing outside your principal market place is yet another terrific tactic at a diversification understanding). Remote domestic real estate investing is actually a increasing development and we've been witnessing a growing number of of computer at Roofstock. In reality, nearly all our purchasers dwell above 1,000 mls away from their properties.

one. Get pre-approved

If you're set on getting an investment home, it can be important to get pre-permitted to get a mortgage. As a result, you'll certainly have an idea of what you might and will not manage to pay for. Call your community financial institution or home loan official figure out the top end of your price structure is very you realize your position. It's also possible to reap the benefits of entire real estate property industry including Roofstock, which offers respected companions for every aspect of worth it practice-which include finance, insurance coverage and property or home administration.

It is additionally valuable to enjoy a conversation with your financial institution about the type of mortgage loan which causes impression in your case. For example, a 15-year home finance loan often have lessen rates and help you pay back forget about the qualities faster. By using a 30-year personal loan, on the other hand, your hard earned dollars is not as occupied. You can love bigger regular monthly income as well as additional versatility to utilize that revenue on an emergency provide for or save it up for your next put in on another investment decision property. It all depends for your spending plan and non commercial real estate investing key elements and recognizing this upfront might help proceed factors alongside. Make sure you for your qualified personal consultant with this.

Rule: Split up into a good investment house on Roofstock, you can takes place unique loan company or our authorized loan companies. You can leverage Roofstock's resources and companions very little or up to you need.

2. Collection a few desired goals

These must not be absolute all of which will very likely change as you grow extra versed within the home real estate investing living space. But generally speaking, determining what on earth is critical to your account from the beginning will actually choose approach less complicated as well as assist you prevent investigation paralysis when limiting the sea of financial commitment house choices. The following is an example of some fundamental points to consider at the beginning of your shelling out vacation:

Spending budget: Placed a ceiling which makes sense in your case (and your pocket book) and stick to it. For anyone who is loans, toddler in excess of-influence yourself. DangerFor eachcome back tolerance: That isn't complete, but they can lessen-glowing qualities are often less risky ventures greater-glowing homes feature a bit more risk. Either have the prospect a place with your local rental stock portfolio-it's simply a matter why you might be getting lease income components precisely what you aspire to realize. Are you searching for bigger month-to-month earnings, a lot more balance, or anything concerning? Love: This is actually the surge in value of ignore the property after some time.

If bigger month-to-month earnings is not as vital and you treatment more to do with increasing equity with time, you may focus on properties with higher understanding potential. Figuring out this will help you in limiting your options. For instance, you would possibly center on reasonably "new" qualities (by way of example - constructed right after a specific calendar year including 1980), certain promotes, location qualities, and so forth. much less on hat rate or monthly profit. Cover rate: This is the predicted amount of gain when using expenditure property or home. Cover rates are assessed by splitting up web doing work profit while in the initial year with the residence final cost. At Roofstock, our current market attributes several different limitation rates usually which range from 4-11Per-cent. Since we discussed previous, distinctive hat charges (the theory is that) can represent diverse degrees of possibility. Greater cover costs may link with a greater level of danger from the invest in, and the opposite way round. This is the reason it can be helpful to think about your limit for risk vs. returning.

Hint: Roofstock delivers programs transparent to evaluate rental investment decision properties, including believed results, appreciation, evaluation records, marketplace and neighborhood data plus more.

3. Master some market language

Like quite a few first-time property investors, no doubt you've been checking forums on Greater Pouches, looking over content articles from Landlordology, downloading it Tune in Income Matters podcasts, and paying some time with Investopedia (or you cannot...we don't appraise). What may appear to be lots of business terms and countless shortened forms-1031s, REI, REITs, NOI, leverage, Loan to value, amortization, Limitation Ex-mate-will all get to grips territory promptly. By being familiar with the words people use-and not only just the achievements, but why it makes a difference-you are going to experience well informed and be in a very better position to help make well informed conclusions.

From high closing costs to unpredicted openings to makeovers and solutions, there may be a high probability operating fees is often more than you firstly count on. This doesn't mean you've made an unsatisfactory purchase, it simply means your targets close to possibilities managing expenses had been ignored in the starting point. Some prices are super easy to anticipate. These include basic doing work bills, settlement costs as well as other assumptions detailed in the monetary professional forma like home taxes, operations costs and insurance coverage (Tip: Roofstock delivers doing this in your case straight up, which supports you spending budget as a result when you are getting prepared to buy an expense house). Other expenses are unattainable to foresee and only have the property of proudly owning rental. We suggest keeping the very least backup fund around 1-2% of the retail price.

5. The places you invest in does not must be somewhere you had live

Evaluating a property determined by charm on it's own the type of blunder new real estate investors often make. Though it really is organic in order to create an impression according to personalized disposition, try to remember: You are not one that is relocating. Rather, consider: "Is definitely the home I am getting likely to be desired to your pair of property owners? Should it be a retired person, several grouped individuals, loved ones with boys and girls in school or a person that needs to live at the international airport, different things will matter to different folks. Being an entrepreneur it isn't of your requirements-sturdy regardless of if the home will commute the the sort of dividends you're looking for. Please don't refuse a building according to beauty only as one of the most lucrative lease homes please don't appearance that special initially.

"It's not a difficult invest in like it may be for just a house that you'll stay in, in which you adore the countertop or maybe the backyard. Under consideration what is the files, what on earth is my give back, and where do I have to commit?"

6. Target the spot, not only the house themselves

As a possible individual, spot ought to be heavily weighed inside your acquire selection. Is the urban center expanding? Does it have a numerous economic climate? Performed a major business just lately re-locate there or start a second headquarters? What about the area? How would be the educational facilities and what sorts of nearby conveniences are there? Conduct some analysis available on the market(vertisements) under consideration (this could actually be form of a new experience) to get an understanding of what is happening in the region. You may also talk with a local property owner to get their take on the procurment market characteristics. Suggestion: At Roofstock, we will connect you specifically and among our professional house professionals who'd be very glad to give you some supplemental awareness.

7. Lover up

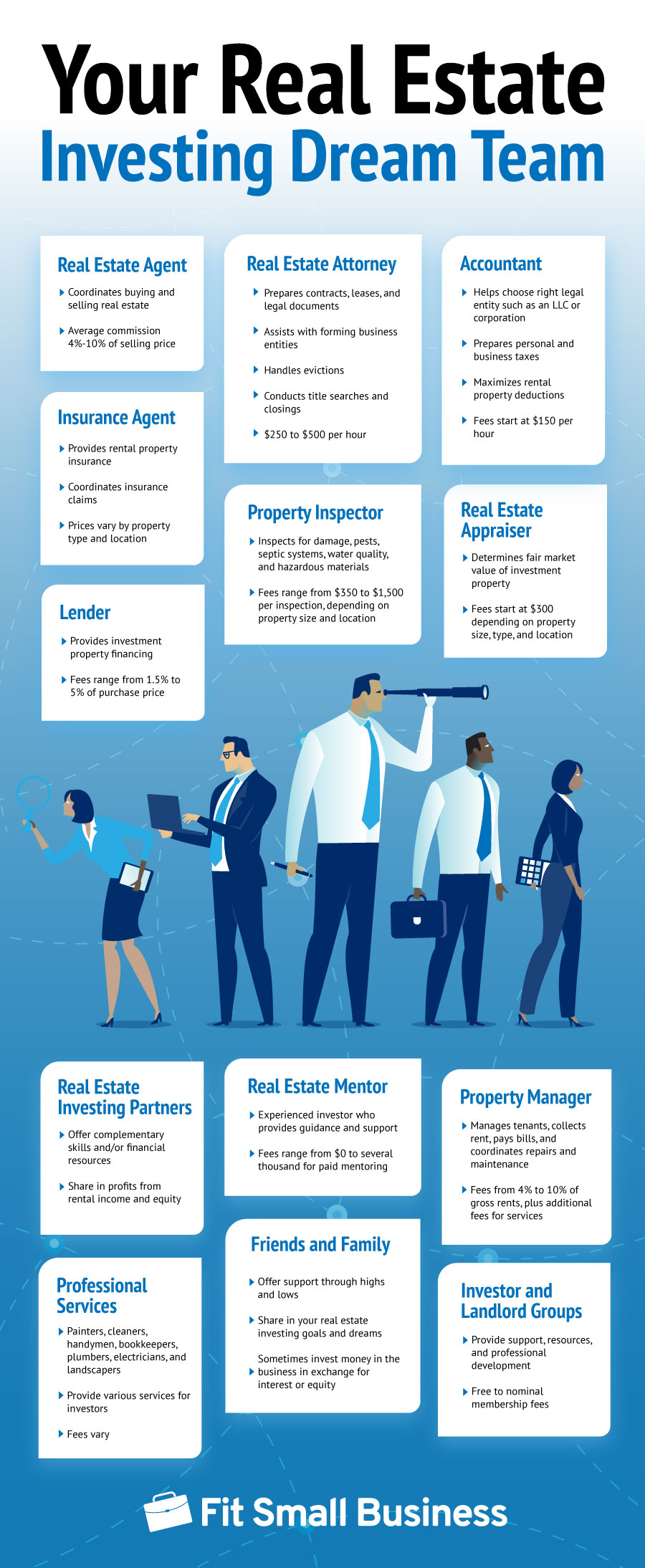

The organization you continue will define who you really are as trader and assist you in getting most out of overlook the properties. By profiting the knowhow and information these days using the know-how and providers of common housing authorities, the number of choices improve tenfold. From residence operators and real estate brokers, to handy applications and computer software, to ground breaking market segments that allow you to purchase complete attributes thoroughly on-line, each one has worth to deliver.

Conventional wisdom to ignore...or at best think about

one particular. You'll want to individual in your geographical area before you buy accommodations

Thriving real estate property trader Grant Cardone states, “you ought to rent payments in your town and personal what you can lease to other people.Inches He says this for the reason that it gives you a lot more versatility to machine as being a property entrepreneur. Nothing is completely wrong with buying your personal put, not surprisingly. But implying that this is necessary to very own your home simply uses become a venture capital company is really an more and more old school of thought.

2. Acquire regionally

These are dated points, this is another: The concept you have to purchase your entire local rental components in close proximity to in your geographical area, simply because it becomes the admittance and safety to control problems as they quite simply crop up.

These suggestions would have been a great deal more practical before we had the Internet, or stop-to-finish property methods like REIstock. Right now, you'll be able to own purchase houses a huge number of distance clear of where you reside, which makes free you up to get the wholesaling industry that's perfect for you. It isn't difficult with a respected area property owner and good engineering that allows watch and course the performance of your hire account everywhere.

3. You need to commit time and effort focusing onPerdealing with your houses

This is usually a yes and no misconception. If you decide to pick the self-been able committing strategy, you might unquestionably alarm clock a lot of working hours into working your home-in particular when you size your profile to add in over a husband and wife houses. On the other hand, you may go on a far more inactive strategy and independent investing from the morning-to-day time responsibilities for being a proprietor by hiring a house administration organization.

some. You will need a ton of money to start

Expenditure qualities that profit and price fewer than Usd100K go about doing occur-you just need to know where to appear (hint: this is the Midwest and Southern). For under $20K decrease, it is possible to own a excellent purchase property or home that provides second income so enabling you develop very long-period success. We all know Bucks20K isn't really chump modify for the each day opportunist, but saving up to the advance payment is without a doubt obtainable using a plan plus a spending budget.

5. You should wait for an subsequent accident before investment

If there are one particular guarantee we’re will make in this post, it really is this: nobody can thoroughly anticipate the longer term market. Alternatively, we like to the tactic of leading investment imagination like Ray Dalio and Warren Buffett: They consentrate on that you can’t anticipate the future but you can get prepared for it. And as the previous Asian proverb moves, "The perfect time to grow a woods was 19 years ago. The next best time is already."

6. You'll want to spend the money for class that's exactly becoming advertised to your account

Pause previous to handing over a large amount to go to a neighborhood property seminar or receive mentoring originating from a "guru." It's hard to determine which kind of ROI you will escape this, or no. Presently, there are many wonderful (and absolutely free) informative awesome realeflow useful property investors, much of our faves getting podcasts, discussion boards and sites.

For starters, investing in the initial rental might be both equally enjoyable and horrifying. Among the best rewards you are able to allow will be to continually look for knowledge, neighborhood, and new technologies that streamlines processes and allows much better choice-producing. This is usually a vacation, and you don't have to go it alone.